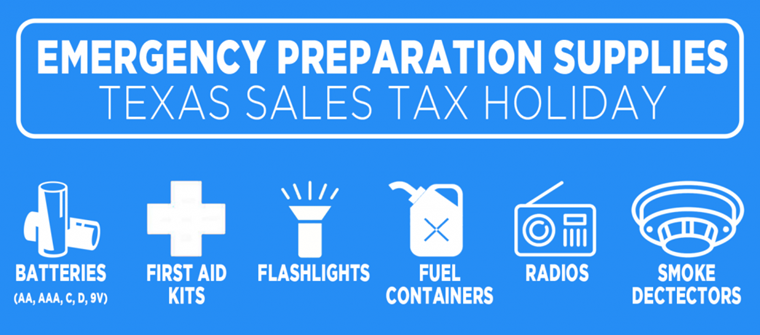

Natural disasters will continue to happen, even during the COVID-19 pandemic. Prepare yourself during the 2021 Emergency Preparation Supplies Sales Tax Holiday for emergencies that can cause physical damage like hurricanes, flash floods, and wildfires. You can purchase certain emergency preparation supplies tax-free during the sales tax holiday. There is no limit on the number of qualifying items you can purchase, and you do not need to give an exemption certificate to claim the exemption.

This year’s holiday begins at 12:01 a.m. on Saturday, April 24, and ends at midnight on Monday, April 26.

Online Purchases and Telephone Orders

To encourage social distancing, the Texas Comptroller’s office wants all taxpayers to know that during the Emergency Preparation Supplies Sales Tax Holiday, the sale of emergency preparation supplies purchased online or by telephone, mail, custom order, or any other means other than in-person qualify for sales tax exemption when either

- the item is both delivered to, and paid for, by the customer during the exemption period; or

- the customer orders and pays for the item and the seller accepts the order during the exemption period for immediate shipment, even if delivery is made after the exemption period.

- A seller accepts an order when the seller has acted to fill the order for immediate shipment.

An order is for immediate shipment regardless of whether the shipment is delayed due to a backlog of orders, or because stock is currently unavailable to, or on backorder by, the seller.

In-Store Purchases

The Comptroller strongly encourages all taxpayers to buy emergency preparation supplies at their local retailers during the sales tax holiday to practice appropriate social distancing as described in the Center for Disease Control and Prevention guidelines.

A complete list of what may be purchased can be found here.